The Simple Roth IRA Conversion Strategy for Financial Independence

In the COVID-19 era, we have experienced some of the largest market swings in US stock market history over a very short period of time. Given all the market uncertainty and volatility, now is a good time to reevaluate FI investing strategies:

Ever since the advent of the Roth 401k, there has been an ongoing debate over whether one should contribute to tax advantaged investment accounts on a pre-tax or post-tax basis or some blend of the two. Some “experts” will say that you should invest in Roth (post-tax) early in your career and traditional 401k (pre-tax) late in your career in order to optimize tax savings. The fundamental idea is that you will be in a higher tax bracket at the end of your career so you should pay the tax early when you are in the lower bracket. Late in your career, you have a high tax burden on a (hopefully) higher income and therefore should invest in traditional 401k to lower your tax burden.

This issue with this philosophy is that it assumes two things:

1.) Your income and spending in retirement will be higher than at the early part of your career.

2.) You don’t want to use any retirement funds until you are 59.5.

Many studies have shown that spending for retirees is often lower than during their working years. For anyone that wants to join the early FI club, accessing “retirement” funds at any time is crucial, not just the arbitrarily defined retirement age of 59.5 (or 67, or whatever). If your goal is early financial independence, increasing your pre-tax contribution (as opposed to Roth 401k) is essential since it will guarantee a lower tax burden during your working years and leave you more after tax (and after expenses) income in your working years to save and invest.

The 401k – Roth IRA Conversion Ladder

Accessing (spending) 401k funds before 59.5 results in income tax liability and an additional 10% tax penalty. However, conversions from 401k to Roth can be done at any time with no penalty (other than normal tax liability). Unlike normal contributions to the Roth IRA, though, the principal from these conversions can only be accessed without penalty after a 5 year period. Due to this 5 year waiting period, the Roth-IRA conversion “ladder” strategy has emerged. The idea is to convert some 401k balance to Roth every year for 5 years (and beyond if possible) and then take the first year’s contribution out of Roth penalty free in year 6, the second year’s contributions out in year 7, and so on. Using this strategy, you can effectively avoid ever paying high taxes on 401k funds, accessing 401k funds at virtually any age (plus 5 year waiting period), and never pay any penalties.

Let’s take look at some specific scenarios:

Assumptions:

7% real average market returns (a safer assumption would be 4% to take into account market volatility risk and sequence of return risk)

Roth conversions occur at no higher than 12% marginal tax bracket (not including state and local income tax)

401k contribution limits and tax brackets keep pace with inflation

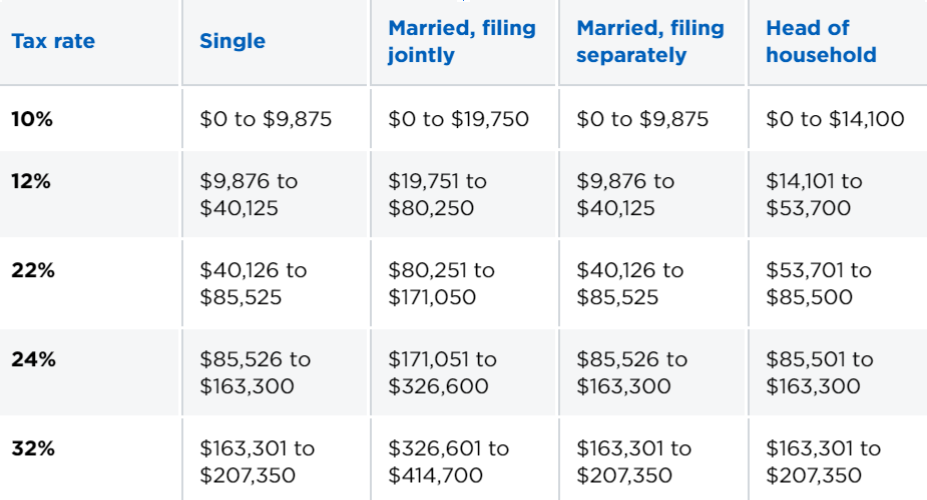

2020 Federal Income Tax Brackets

Scenario 1: Extreme Early FI

Work 14 years, max 401k + $4k employer match

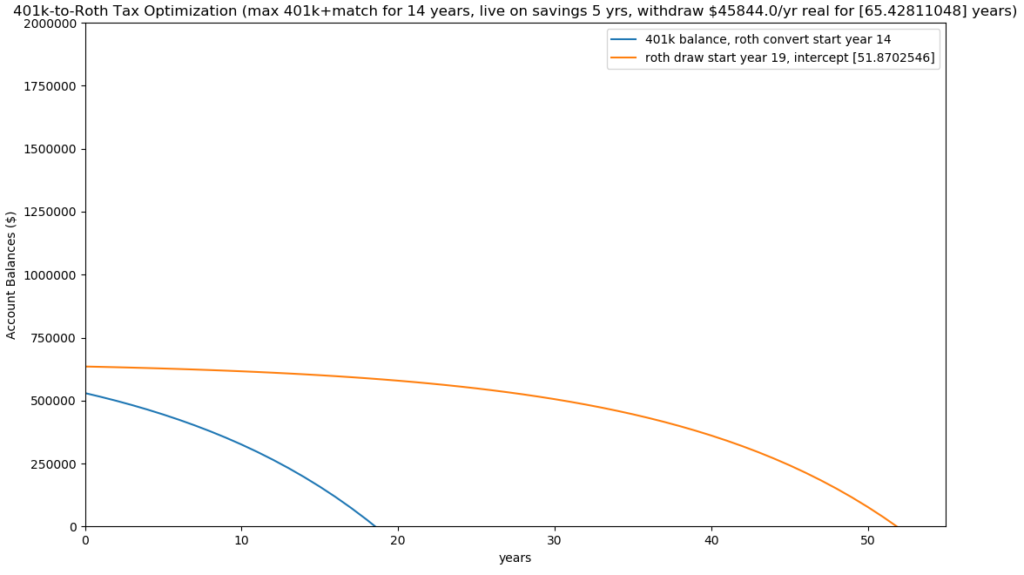

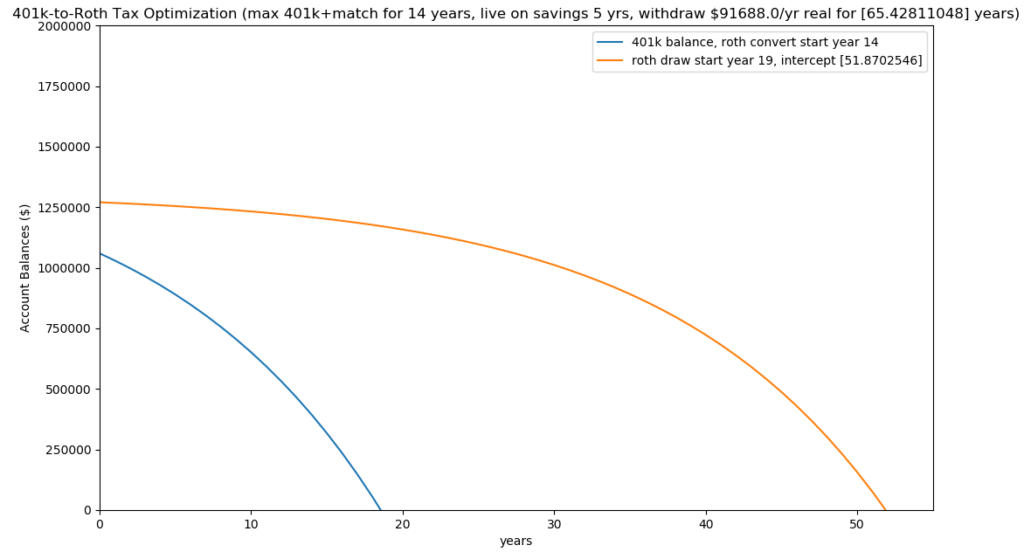

Joe works for 14 years maxing his 401k (19,500) the entire time (with a $4k employer match) for a contribution total of $23,500 per year. At the end of these 14 years, he no longer works (zero income) and starts converting money in 401k to Roth, incurring taxes in the process. In order to minimize tax liabilities, Joe converts $52,000 per year in order to stay in the relatively low 12% marginal tax bracket for single filers ($40k + $12k standard deduction). During the first 5 years of Roth conversions, Joe lives on money that he has saved in a taxable brokerage during his 14 year career in order to keep his income low as he is already generating over $50,000 in artificial “income” from his Roth conversions. After the first 5 years of conversions, or year 19 of his “career”, Joe can start withdrawing $46,000 per year from the Roth account without any taxes or penalties and at any age. Joe can only withdraw up to $46k since this is the after tax amount of the $52k that was converted to Roth 5 years prior.

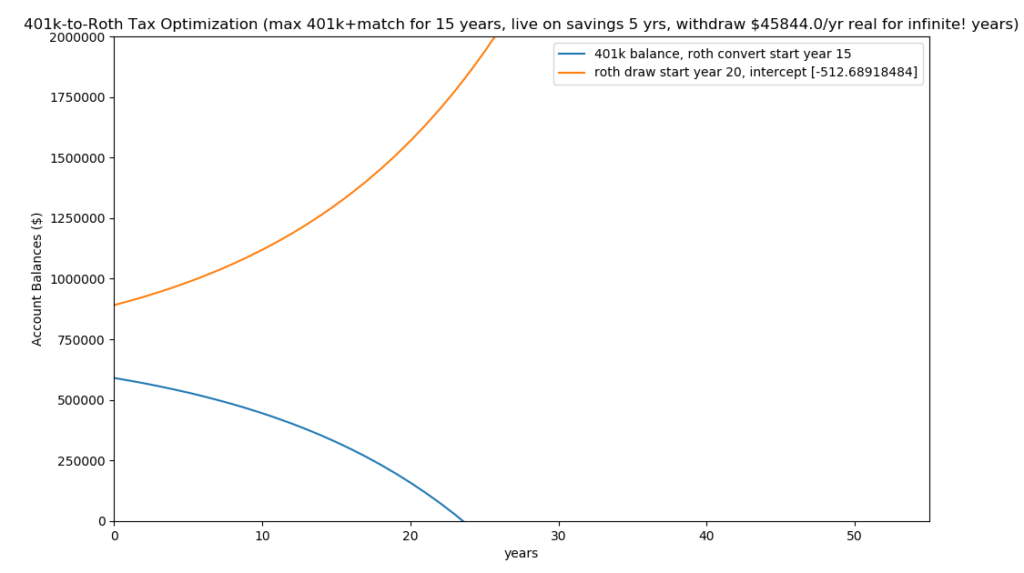

The chart below shows the drawdowns of both the 401k and Roth account over time using this strategy. The time for the blue line starts when the Roth conversions start in year 14. The time for the orange line starts when the 401k account is fully depleted from Roth conversions. In this scenario, that is an additional 18 years, so the orange line starts in year 32. The orange line shows that Joe can effectively withdraw $46k for over 50 years (starting in year 32) before the Roth account is finally exhausted! If he were to work 1 year longer (15 years), this Roth account (orange line in second chart) would never go to zero under a 7% real return assumption. Not bad for an effective $46k after tax income in “retirement” compared to the median pre-tax household income in the US of $61k.

Scenario 2: FI in early 40’s

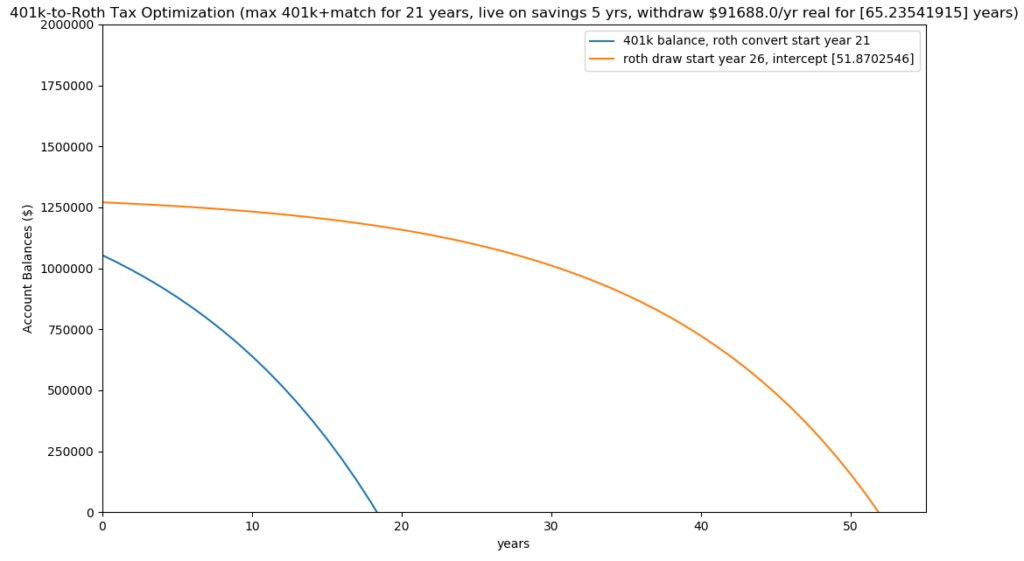

Work 21 years, max 401k + $4k employer match

In this scenario, Joe is married and works for another 7 years (maxing the 401k of course) while his spouse does not earn any income. He will still need to have enough after tax savings in a brokerage to fund a lifestyle from year 21 to year 26 while he is beginning his Roth conversions. After year 26 he will be able to withdraw $92k tax free from the Roth account for roughly 65 years. Since he is filing with a married status, he can double his conversions and Roth withdrawals while still staying in the 12% marginal tax bracket.

Scenario 3: Married and Dual Income Early FI

Work 14 years, max 401k + $4k employer match

Joe and Jane both work and both invest the max 401k contribution plus $4k employer match for a total of $47,000 per year. Again, they will have to live on savings from years 14 to 19 as in the first scenario, but they will be able to withdraw $92k for 65 years (basically indefinitely) thereafter.

⭐️⭐️⭐️⭐️⭐️Helpful guide for uncertain times. Thank you millennial saver!